Being diagnosed with a critical illness is a life-altering event. Not only will it affect your health, finances and emotional wellbeing, it will also take a toll on your loved ones and their future. With so many challenges in front of you on the road to recovery, it’s comforting to know there is a comprehensive critical illness rider that can support you through these trying times.

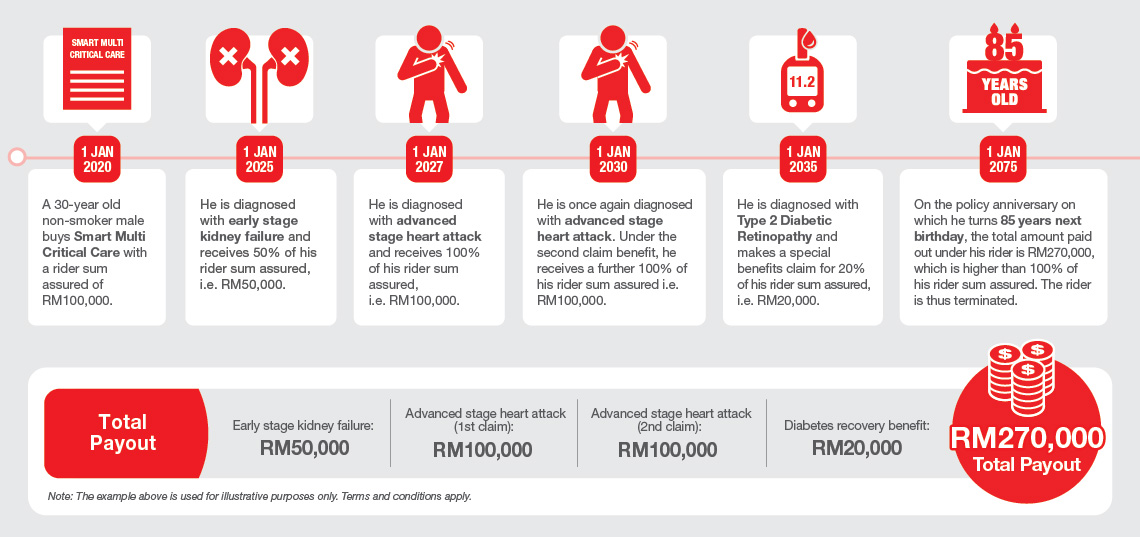

Smart Multi Critical Care provides you with extensive coverage against 188 conditions through the plan’s critical illness benefit as well as special benefit. You’ll be pleased to know that multiple claims are allowed across early to advanced stages of the critical illness benefit. What’s more, the total coverage payable under the critical illness benefit and special benefit can be up to 860% of the rider sum assured. With Smart Multi Critical Care, you and your loved ones will have a strong financial buffer, so you can focus on what’s most important – your recovery.

Critical illness coverage up to 800% the rider sum assured

Smart Multi Critical Care offers comprehensive coverage against 178 critical illness conditions across early, intermediate and advanced stages1 , up to a total of 800%2,3 the rider sum assured4 .

Additional special benefit of up to 60% the rider sum assured

Get coverage beyond the customary illnesses with an additional 20% of your rider sum assured for diabetes recovery6 , mental illness7 , and total quadriplegia resulting from spinal cord injury8,4 .

Double protection against cancer, heart attack and stroke

You are entitled to receive up to an additional 100% of your rider sum assured for each of these 3 prevalent critical illnesses5,4 .

Continuous protection up to age 100 years next birthday

Depending on your selected investment-linked insurance plan and rider coverage term, this rider protects you up to the age of 100 years next birthday4 .

Please do take note of the below to ensure you fully understand what this product does and does not cover.

1 The percentage of the rider sum assured payable depends on the stage of the critical illness.

2 Only applicable prior to age 85 years next birthday, after which the total amount payable for the critical illness benefit will become 100% of the rider sum assured.

3 Subject to a maximum of RM4,000,000 per life, aggregated with all critical illness benefit payable under all policies (excluding Bancassurance and Group policies) issued by the Company.

4 Terms and conditions apply.

5 Subject to a maximum of 400% of the rider sum assured in aggregate for cancer, heart attack and stroke.

6 The diabetes recovery benefit will cease at age 85 years next birthday.

7 The mental illness benefit is subject to a maximum of RM150,000 per life.

8 Only 1 claim is allowed under each of the special benefits, up to an aggregated total of 60% from all special benefits.

Smart Multi Critical Care is a unit deduction rider attachable to selected regular premium investment-linked insurance plans. These plans are insurance products that are tied to the performance of the underlying assets, and are not pure investment products such as unit trusts. The insurance charge to be imposed will be deducted from the total investment value of your policy on a monthly basis. You may stop paying premiums under the policy and still enjoy protection as long as there is sufficient total investment value to pay for the insurance charge. However, there is a possibility of the policy lapsing when the required charges, including rider charges exceed the total investment value of the fund units available. Purchasing too many unit deduction riders may deplete the fund units.

You should satisfy yourself that this rider will best serve your needs and that the premium payable under the policy is an amount you can afford. A free-look period of 15 days is given for you to review the suitability of the newly purchased Medical and Health Insurance product (MHI). If a rider is cancelled during this period, the policy owner is entitled to the reinstatement of the units deducted for the payment of insurance charge after net of expenses incurred for the medical examination, if any. If you switch your Medical Policy/Rider from one company to another or if you exchange your current Medical Policy/Rider with another Medical Policy/Rider within the same company, you may be required to submit an application where acceptance of your proposal will be subject to the terms and conditions to be imposed at the time of Policy/Rider switching or replacement.

The above is for general information only. It is not a contract of insurance. You are advised to refer to the Product Disclosure Sheet, consumer education booklet on MHI and sample policy documents for detailed important features and benefits of the plan before purchasing the plan. The exclusions and limitations of benefits highlighted above are not exhaustive. For further information, reference shall be made to the terms and conditions specified in the policy issued by Great Eastern Life.

If there is any discrepancy between the English, Bahasa Malaysia and Chinese versions of this brochure, the English version shall prevail.

The terms “Great Eastern Life” and “the Company” shall refer to Great Eastern Life Assurance (Malaysia) Berhad.

Information correct as at 25 January 2021.

Malaysia

Malaysia