What is personal bankruptcy? 什麼是個人破產?

Bankruptcy is a process where a debtor is declared a bankrupt pursuant to an Adjudication Order made by the High Court against the debtor if he is unable to pay his debts of at least RM30,000.00.

破產是一個過程,其中一個債務人被宣告破產,根據高等法院的判決令,如果他是對債務人無法支付他的債務,至少RM30,000.00。

When a company is placed into administration or liquidation. The Liquidation Division is divided into two main Sections, which are; Operational section and Policy and Administration Section. These two Sections serves the Liquidation Division according to the needs of Corporate Insolvency .

當一家公司被置於管理或清算。清算司分為兩個主要部分,這是操作部分和政策及行政組。這兩個部分提供清算司根據企業破產的需要。

Before bankruptcy, appoint Magic Consultancy as consultant, we will try to save your company from bankruptcy and to secure your existing assets?

破產前,委任魔術顧問公司作為顧問,幫助您保住你现有的资产?

1. ReStructuring : Apply more lowest interest rate loan and refinance existing property to cover high interest loan – try to avoid bankruptcy 重组高利息贷款,用更加低的利息还现有的商业贷款,個人貸款,信用卡,車。

2. Injecting New Capital 注入更多资金 (potential only)

3. Integrate with other party which have synergy 行业资源整合

4. Restructure existing cash in to high returnable asset轉出所有現金

5. Sell out existing valuable asset 套现現有的有價值的资产

Why we need your help??? 為什麼我們需要你的幫助?

1. To maximize your cash flow management 為了最大限度地提高您的現金流

2. To ensure your future have more cash on hand為了確保你的未來有更多的手頭現金

3. To secure your existing house & other properties 為了保護您的現有房屋及其他产业

4. We have special appointed person to you Personal Assitance 一位个人助理会专门协助你

常問問題

1。破產繼續使用其現有的信用卡?

破產人只能使用自己現有的信用卡RM1000.00量。如果想超過RM1000.00 ,他必須通知發卡銀行或財務公司,其破產的狀態。如果失敗,他將被視為已根據“破產法” 1967年犯下的罪行。

2。破產DGI提出申請,以減少債務的數額?

NO ,他應該寫在滿足人員在特定的銀行,說明他這樣做的意圖。

3。破產進行直接支付給債權人,以解決他的債務嗎?

NO ,所有款項必須通過DGI 。付款將被記入房地產帳戶,並分發給債權人提交債權證明。

4 。破產,可以開立銀行賬戶,或者繼續使用他現有的帳戶?

可能會開立銀行帳戶,或繼續使用其現有的帳戶,如存入他的薪金或任何利潤上漲的原因,他獲得許可的DGI 。

5 。破產轉移財產?

他的財產將自動歸屬於DGI 。

6 。破產海外旅行?

YES。說明他的意圖,理由和時間旅行的申請。

– 工作

– 手術/治療

– 朝圣

– 朝覲/副朝/宗教

– 死亡的家庭成員是誰生病/杜尼

– 社會的訪問已婚/出席婚禮/畢業/探親/保姆/陪丈夫

7。作為公司的董事,如果我能保持我已經做了一個破產?

NO 。破產是不允許的:

(a)業務工作的配偶,子女或親戚;

(b)進入或開展任何業務,單獨或合作。

8。做我的債權人有權抓住我的財產後,我一直在破產?

沒有你的資產歸屬於DGI 。

9。破產如何才能釋放他的破產狀態?

如何可以終止其破產的破產,主要有三種方式:

(一)在法庭提出申請為由廢止破產令在任何時間 即債務已全額支付,或者說他不應該被一些技術破產理由;

(二)在法庭上提出申請隨時法院放電。這是受到嚴格要求和破產管理署已經把一個報告,其中強調

行為與合作的破產與部門。

(三)提出申請DGI “ 1967年破產法”第33A條下放電。這樣應用程序只能在只有5年已經失效的日期順序時DGI他的自由裁量權的行使施加滿足一定標準。其中的因素DGI將考慮破產的行為,的程度跟我們合作,破產,年老體弱等原因

10。我該如何進行破產搜索?

您可以進行網上搜索我們的網站www.insolvensi.gov.my下的“服務”鏈接。 RM12.00的費用將會從您的信用卡中扣除。請注意,僅通過信用卡付款必須做的。另一種方法是通過在我們的總部普特拉賈亞計數器。 RM10.00的費用,是通過現金支付。在15分鐘內,您將收到破產的搜索結果。

11。有一種可能性,一個人可以在他不知情的情況下被宣布破產?

是,發送到他的老地址,他不更新自己的地址,沒有達到他,不讀報紙,如果送達的取代的服務程序,他並沒有露面,他在法庭上不打擾接受或打開他的地址發送給他的任何法律文件。

12。是否有自動解除破產?

有沒有自動解除破產人在馬來西亞法律,不論年齡。

只有具有良好的行為破產可以考慮放電。

良好的行為是指:

(一)良好合作當MDI的任何人員;

(二)在被判定破產,他將出席MDI的辦公室時,立即要求這樣做;

(三)已提交了一份完整的聲明性事務在規定時間內給予MDI ;

(四)付款或每月供款的規律;

(五)符合與DGI和法院命令;

(六)符合“ 1967年破產法”第38條下的所有限制;

(七)提交的收入和支出報表每半年;

(八)通知部的任何變更地址和收入;

(九)並無任何直接支付給債權人;

(十 )股息宣言

•健康問題/延長疾病(醫療報告支持) ;

•太舊(70歲及以上) ;

•案件管理超過5年。

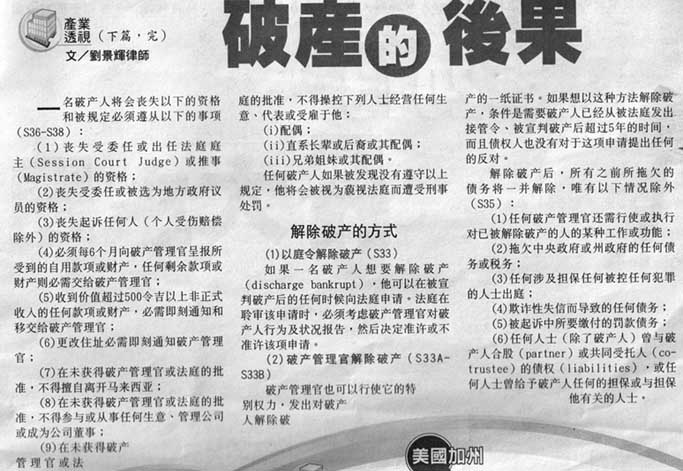

12。破產的取消資格是什麼?

判決後,破產人被取消資格:

(一)持有國會議員的辦公室;

(二)擔任公職;

(三)法定機構,註冊社團或組織的某些位置;

(四)在某些專業執業;

(五)企業單獨或合夥或某公司的方式進行;

(六)從事的業務相對;

(七)繼續進行任何訴訟DGI以外的其他訴訟,要求賠償傷害他的人respet未經批准;

(八)離開馬來西亞沒有以前的許可的DGI或法院;

(九)領取養老金或其他酬金;

(十 )執行某些法律賦予他的權利。

13。破產的職責是什麼?

破產人的職責包括:

DGI的辦公室和判決令與DGI和其他後續會議通知時,接收訂單後盡快參加;

把所有資產移交給DGI ;

提交一份完整的聲明性事務;

提交收支報表每六( 6)個月;

出席債權人會議;

貢獻/對破產財產的個人收入支付;

不要取得進一步的信貸;

應獲得信貸RM1 , 000.00或以上,沒有任何人通知他的狀態作為債權人的破產;

不直接向債權人付款;

DGI立即通知的所有更改姓名,地址,電話號碼,收入,財產和其他有關資料;

DGI的查詢,在規定時間內;

DGI ,法院的命令和規定,遵守1967年“破產法”

破產管理署(MDI )

FAQ

A bankrupt can only use his existing credit card up to the amount of RM1000.00. If wish more than RM1000.00, he must notify the issuing bank or finance company as to the status of his bankruptcy. If fails, he will be deemed to have committed an offence under the Bankruptcy Act 1967.

NO, he should write in or meet the officer at the particular Bank stating his intention to do so.

NO, all payment has to be made through the DGI. The payment will be credited into the estate account and distributed to the creditors who have filed in Proof of Debt.

May open a bank account or continue using his existing account for reasons such as crediting his salary or any profit gained provided he obtains the permission of the DGI.

NO his property shall be automatically vested upon the DGI.

YES. an application by stating his intention, reasons and duration of travelling.

– Working

– Operation/treatment

– Haji/umrah / keagamaan

– Ahli Keluarga yang sakit/meninggal duni

– Lawatan sosial iaitu berkahwin / menghadiri majlis perkahwinan / konvokesyen / menziarahi keluarga / menjaga anak / menemani suami

NO. a bankrupt is not allowed to:

(a) work in the business of a spouse, children or relative;

and

(b) enter or carry on any business, either alone or in partnership.

NO your assets vest in the DGI.

There are three main ways as to how a bankrupt can have his bankruptcy terminated:

(a) Making an application in court at any time for the bankruptcy order to be annulled on grounds

ie debt has been paid in full or that he ought not to be made a bankrupt on some technical

grounds;

(b) Making an application in court at any time for a court discharge. This is subject to a stringent

requirement and the Insolvency Department has to put a report emphasizing among others the

conduct and cooperation of the bankrupt with the department.

(c) Making an application to the DGI for a discharge under section 33A of Bankruptcy Act 1967. Such

application can only be made only if 5 years has lapsed from the date order was made upon

satisfying some criteria imposed by the DGI for the exercise of his discretion. Among the factors

that the DGI will take into consideration are the conduct of the bankrupt, the extent of his

cooperation with us, the cause for bankruptcy, old age and infirmities etc.

You may conduct an online search at our website www.insolvensi.gov.my under the ‘Services’ link. A fee of RM12.00 will be charged to your credit card. Please note that payment must be done via credit card only. Another method is via counter in our Headquarters Putrajaya. A fee of RM10.00 is payable via cash. You will receive the bankruptcy search result within 15 minutes.

Yes, -sent to his old address; he does not update his address; does not reach him, doesn’t read newspaper if the document is served by a substituted service procedure, he did not turn up in court, he doesn’t bother to accept or open any legal document sent to him at his address.

There is no automatic discharge of a bankrupt in Malaysia laws, irrespective of age.

Only bankrupt with a good conduct can be considered for a discharge.

Good conduct means:

(a) Good co-operation as and when required by any officer of MdI;

(b) Upon being adjudged a bankrupt, he will attend to the MdI’s office immediately when required to do so;

(c) Have submitted a complete Statement of Affairs within a stipulated time given by MdI;

(d) Regularity in making payments or monthly contribution;

(e) Compliance with the DGI’s and Court order;

(f) Compliance with all the restrictions under section 38 of Bankruptcy Act 1967;

(g) Submitting an Income and Expenditure Statements every six months;

(h) Informing the Department of any changes of address and income;

(i) Did not make any direct payment to the creditors; and

(j) Declaration of dividend

· health problem/prolong illness (supported by medical report);

· too old (70 years old and above); and

· case administration exceed 5 years.

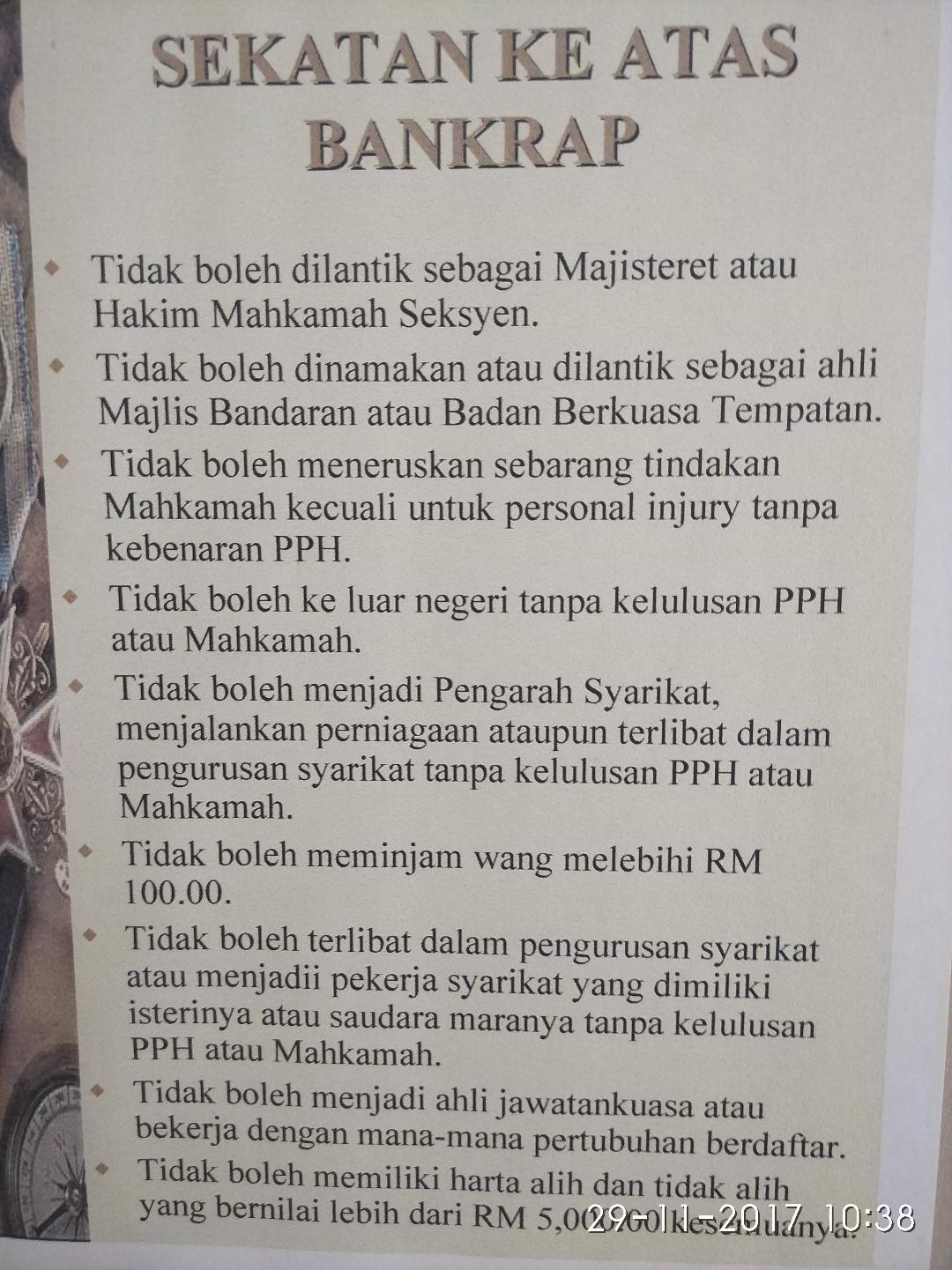

Upon the adjudication, the bankrupt is disqualified from:

(a) holding the office of a Member of Parliament;

(b) holding public office;

(c) holding certain positions in statutory bodies, registered societies or organizations;

(d) practising in certain professions;

(e) carrying on business alone or in partnership or by way of a company;

(f) working in the business of a relative;

(g) maintaining any action without the sanction of DGI other than an action for damages in respet of an injury to his person;

(h) leaving Malaysia without the previous permission of DGI or court;

(i) receiving pension or other gratuity; and

(j) enforcing his rights under certain legislation.

Bankrupt’s responsibilities include:

Attending at the DGI’s office as soon as possible upon the making of the Receiving Order and Adjudication Order and other subsequent meetings with the DGI whenever notified;

Handing over all assets to the DGI;

Submitting a completed Statement of Affairs;

Submitting an Income and Expenditure Statements every six (6) months;

Attending all meetings of creditors;

Making contribution / payments towards bankruptcy estate out of personal income;

Refrain from obtaining further credit;

Shall not to obtain a credit of RM1,000.00 or more from any person without informing the creditor his status as a bankrupt;

Not to make payments direct to the creditors;

Informing the DGI immediately of all changes of name, address, telephone number, income, property and other relevant information;

Responding to the DGI’s inquiries within a stipulated time; and

Complying with DGI’s, Court orders and provisions in the Bankruptcy Act 1967

SOURCE FROM : Department of Insolvency (MdI)

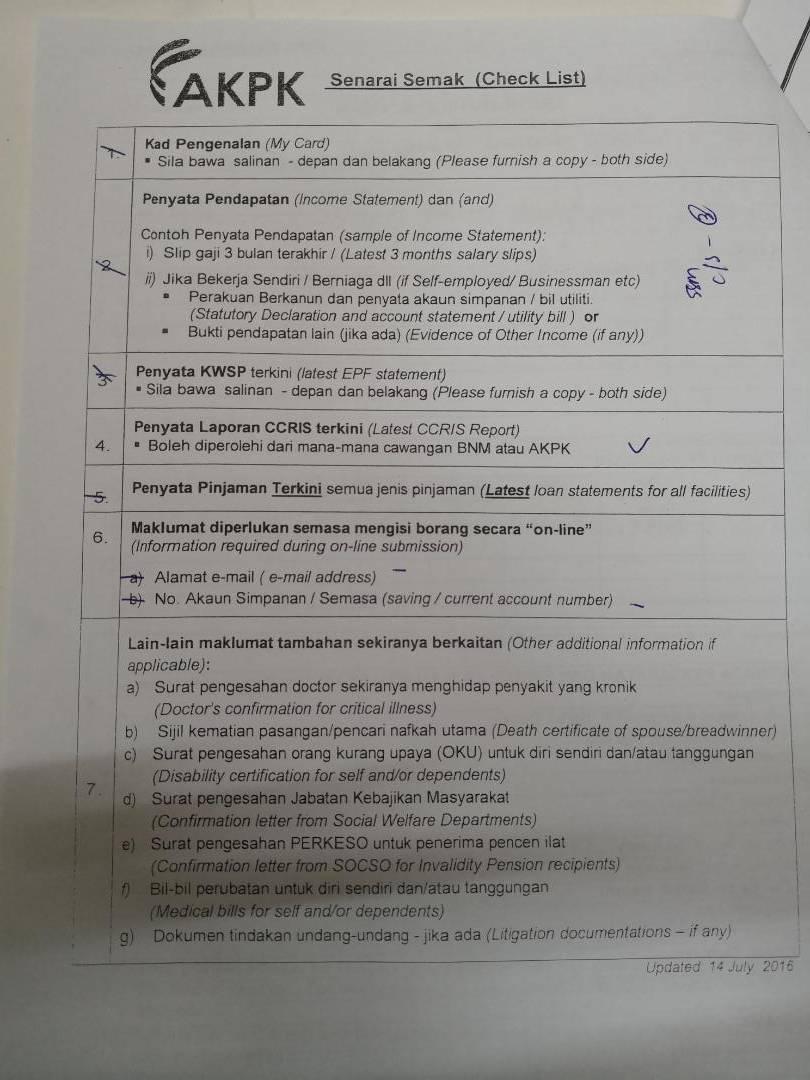

AKPK

BEFORE BANKRUPTCY, FOR PERSONAL DEBT, YOU ARE ADVISED TO GO AKPK FIRST

CHECKLIST AS BELOW

Objective To provide assistance to viable small and medium scale enterprises (SMEs) that are constrained by non-performing loans/financing (NPL/NPF) and distressed SMEs with performing loans/financing under multiple participating financial institutions (PFIs), by facilitating restructuring or rescheduling and where appropriate, providing new financing.

Participating financial institutions / Implementing Ministry / Agency

Scheme Mechanism The scheme involves those applications for restructuring or rescheduling that are submitted under SDRS to PFIs for their consideration. In the event these applications are declined by the PFIs, a dedicated committee, i.e. the Small Debt Resolution Committee (SDRC) established by Bank Negara Malaysia will then undertake an independent assessment on the viability of the business and may propose restructuring or rescheduling if eligible, and new financing, where necessary. New financing will be sourced from existing SME funds and schemes established by Bank Negara Malaysia.

Eligibility criteria

Application procedure

Applicants must use SDRC application form obtained from PFIs or the SDRC Secretariat. The application form (including list of documents required) can also be printed in pdf format

The completed application form together with all required documents should be submitted directly to the PFIs where the accounts are maintained or the SDRC Secretariat.

Contact

SDRC Secretariat Development Finance and Enterprise Department Bank Negara Malaysia (BNM) Jalan Dato’ Onn 50480 Kuala Lumpur

BNMTELELINK Tel: 1-300-88-5465 or 1-300-88-LINK Website: www.bnm.gov.my

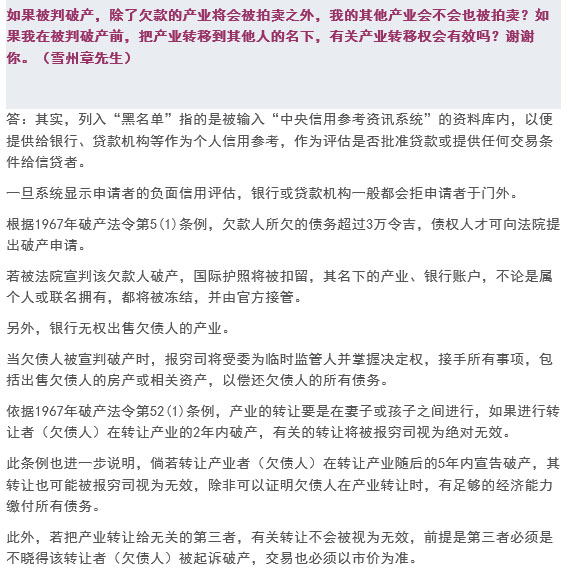

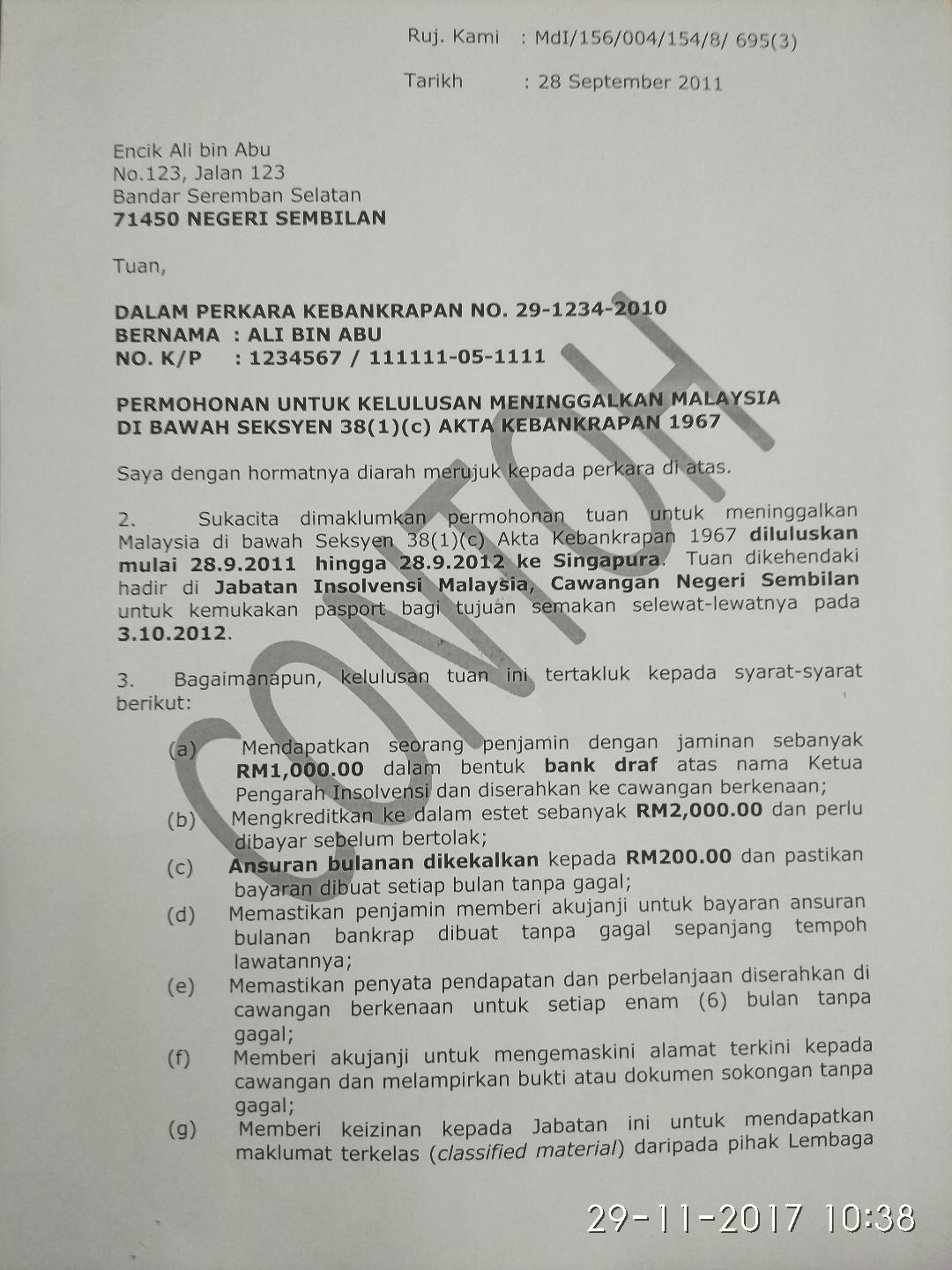

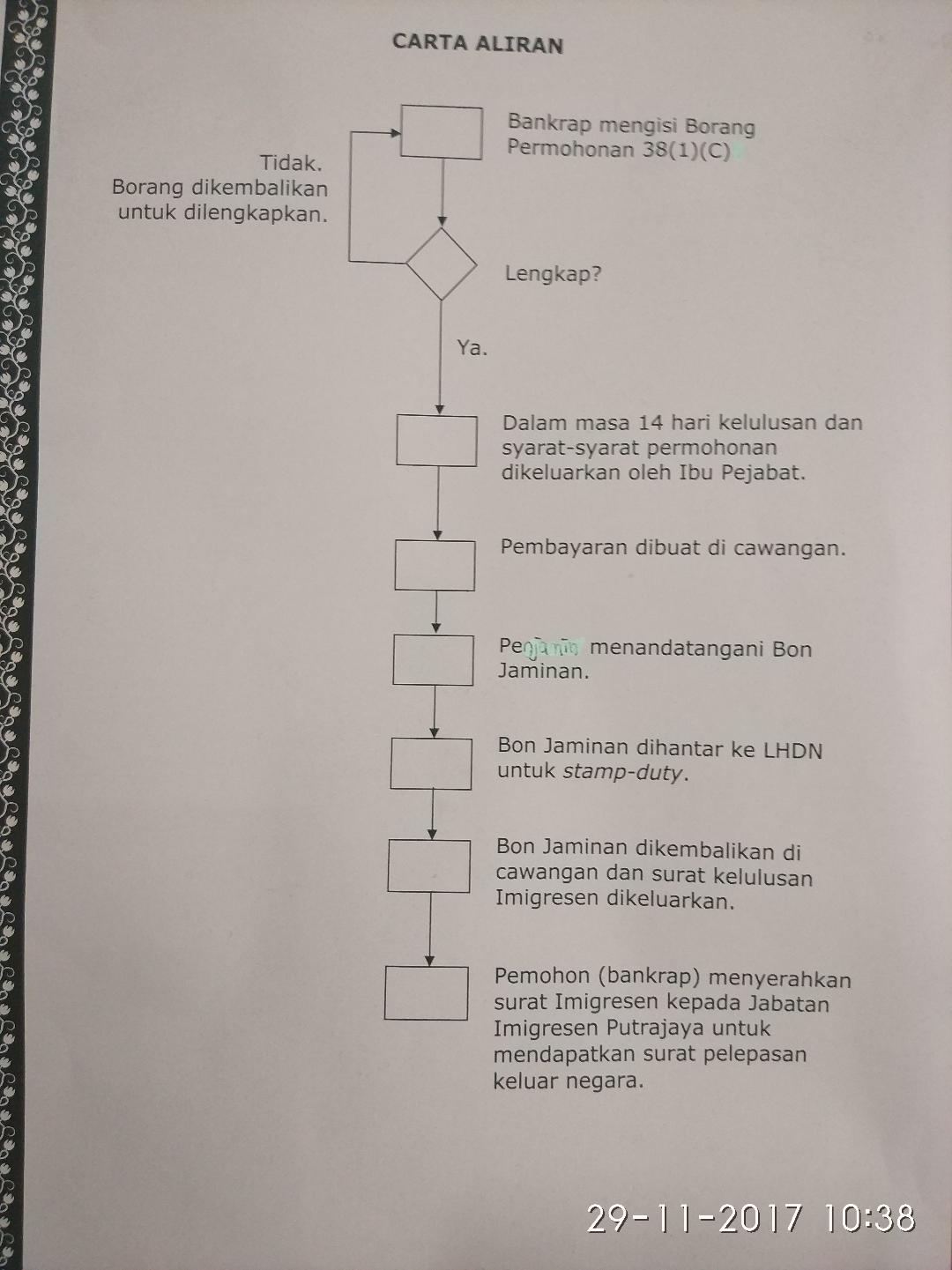

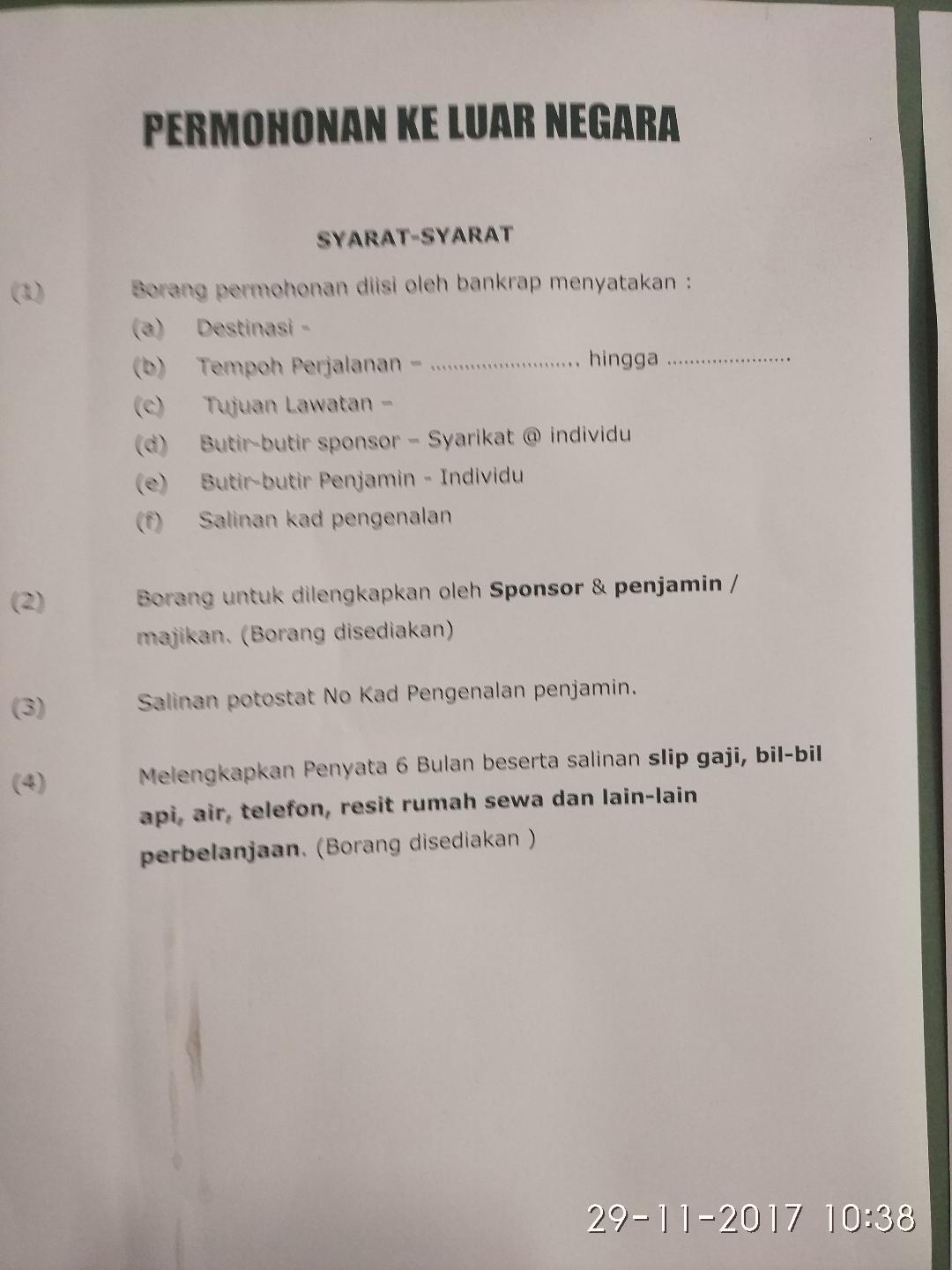

OVERSEA 破产了如何出国

调查你如果黑名单了,还可以出国吗?

Semakan Status Perjalanan

sspi2.imi.gov.my

Malaysia

Malaysia