Objectives

•To provide financial assistance to franchisors / master franchisees to expand their business

•To encourage and facilitate assistance to franchisors to venture into internationalexpansion

•To assist franchisors / master franchisees in strengthening their capabilities and capacity to support franchisees for business expansion

Company Criteria

•A Sdn Bhd company

•Registered with Registrar of Franchise (ROF)

•A member of Malaysian Franchise Association (MFA)

•Registered profits and positive shareholder funds in its latest audited accounts

•The business must be Syariah compliant

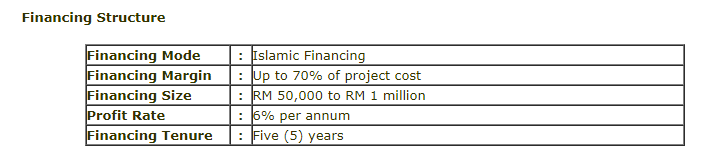

Financing Structure

Financing Amount : RM100,000 to RM2,000,000 / Subject to a gearing ratio of not more than 4 times

Profit Rate : 6% – 8% per annum

Financing Tenure : Up to 10 years

Financing Mode : Islamic Financing

FRANCHISE 融资计划

目标

•提供财政援助,以特许经营/主加盟商拓展业务

•要鼓励和协助特许经营企业到国际扩张

•协助加强他们的能力和容量,以支持业务扩展加盟商的特许经营/主加盟商

公司标准

•一个Sdn Bhd公司公司

•注册注册专营权(ROF)马来西亚特许经营协会的一位成员(MFA)

•注册的利润和积极的股东在公司最近一期经审计账目资金

•业务必须符合回教

融资结构

融资金额:RM100,000至RM2,000,000/

除资产负债比率不超过4倍

盈利率:6% – 8%计息

融资年期:长达10年

融资模式:伊斯兰融资

| FRANCHISEE FINANCING SCHEME | ||||

| - | Objective | |||

|

||||

| - |

Company Criteria |

|||

|

||||

欧文资助计划

客观

•土著加盟商提供融资计划启动或业务扩张

公司标准

•年龄21岁及以上

•最低资格的文凭,将获优先考虑

•企业家是所有者和经营者

•特许人/主加盟商登记注册处处长的专营权(ROF)

•土著所拥有的100%股权

•录取通知书特许/主加盟商

•通过SDN BHD公司的融资申请,融资超过RM250,000

•独资公司申请被限制在低于25万令吉融资

•企业必须符合回教

FRANCHISEE FINANCING SCHEME

Objective

•Provide financing scheme to Bumiputera franchisees for startup or business expansion

Company Criteria

•Age 21 years and above

•Preference will be given to those with minimum qualification of Diploma

•Entrepreneur is the owner and operator

•Franchisor/Master franchisee registered with Registrar of Franchise (ROF)

•100% equity owned by Bumiputera

•Letter of Offer from Franchisor/Master Franchisee

•Financing application made through Sdn Bhd company for financing above RM250,000

•Application by Sole Proprietor is limited to financing below RM 250,000

•The business must be Syariah compliant

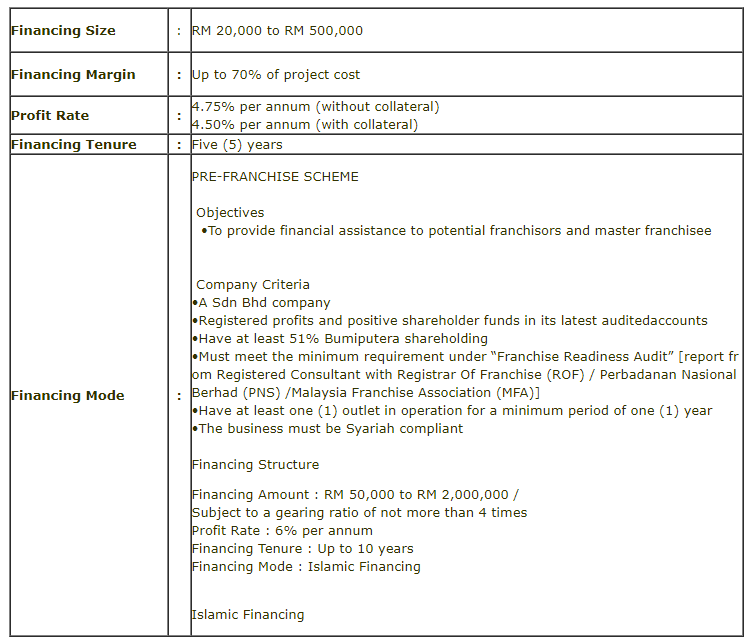

Financing Structure

Financing Size : RM 20,000 to RM 500,000

Financing Margin : Up to 70% of project cost

Profit Rate : 4.75% per annum (without collateral)

4.50% per annum (with collateral)

Financing Tenure : Five (5) years

Financing Mode : Islamic Financing

欧文资助计划

客观

•土著加盟商提供融资计划启动或业务扩张

公司标准

年龄21岁及以上

•将优先给那些最低资格文凭

企业家是所有者和经营者

•特许/主加盟商登记注册处处长的专营权(ROF)

•土著所拥有的100%股权

•录取通知书从特许/主加盟商

•融资提出申请,通过SDN BHD公司融资超过RM250,000

•应用独资公司低于25万令吉的资金是有限的

•业务必须符合回教

融资结构

融资规模:RM20,000马币500,000

融资保证金:高达70%的项目成本

盈利率:4.75%计息(无担保)

每年4.50%(抵押品)

融资任期:五(5)年

融资模式:伊斯兰融资

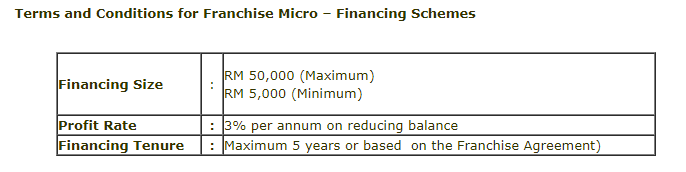

| FRANCHISE MICRO-FINANCING SCHEME (SPKF) | ||||||||||||||||||||||||||||

|

To help entrepreneurs venturing into franchise businesses and generate additional income, the Government through the Ministry of Domestic Trade, Co-operatives and Consumerism (MDTCC) has introduced Franchise Micro-Financing Scheme which offers a maximum funding up to RM50, 000. The scheme provides financing to prospective entrepreneurs to venture into micro-franchising which offers systematic and less risky businesses. |

||||||||||||||||||||||||||||

| - | Objective | |||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| - | Criteria for the Franchise Micro-Financing Scheme | |||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

特许经营小额融资计划(SPKF)

为了帮助创业者涉足特许经营业务,并赚取额外收入,政府通过

国内贸易,合作社及消费(MDTCC)教育部已推出特许经营的微型融资计划提供了最大的资金高达RM50,000。

该计划提供融资未来的企业家进军微特许经营提供系统和风险较小的业务。

客观

该计划旨在提供财政援助小(微特许经营)当地加盟商低收入和中等收入的最大融资高达RM50,000。

特许经营的微型融资计划的标准

1。 21岁及以上,并在申请之日起不超过65年;

2。打开当地的加盟商与当地的特许经营,特许经营特许经营法“1998年第6款注册处处长登记;

3。应通过有限责任公司/合伙企业/企业应用;

4。申请人企业家谁是业主/运营商的业务;

5。有从本地特许经营要约函件;

6。注册公司委员会的马来西亚(CCM);

7。本地100%的国有企业(独资/合伙企业/私人有限公司);

8。未列入黑名单的金融机构(* CCRIS记录显示未偿还分期不超过2个月);

9。没有宣布破产;

10。没有处理任何法庭诉讼程序的;

11。商务进行伊斯兰教法为基础的业务;

12。特许经营包不超过RM50,000与MRTA其他相关费用,法律费用,包括融资的90%的保证金;

13。必须获得信贷融资超过RM10,000的委任回教保险覆盖率由PNS

| FRANCHISE EXECUTIVE SCHEME | ||||

| - | Objectives | |||

|

||||

| - | Company Criteria | |||

|

||||

特许执行计划

目标

•为了鼓励更多Bumiputera股东在公共和私营部门的特许经营业务进军

•专注于那些谁是涉及在自愿离职计划(VSS)或提早退休

公司标准

•25岁及以上

•优先考虑向申请人最低资格文凭

•特许人/主加盟商登记注册处处长的专营权(ROF)

•土著所拥有的100%股权

•录取通知书特许/主加盟商

•企业家是所有者和经营者

•通过SDN BHD公司的融资申请,融资超过RM250,000

•低于25万令吉的资金是有限的融资申请独资公司

Malaysia

Malaysia