Flora Wong & Associates Sdn. Bhd. and Flora Trustee Berhad will assists you,

PLEASE NOTE THE FOREGOING IS GENERAL INFORMATION. WE SHOULD DISCUSS YOUR SPECIFIC SITUATION IN DETAIL TO PREPARE YOUR WILL AND OTHER ESTATE PLANNING DOCUMENTS.

Differences between Wills and Living Trusts |

||

Will |

Living Trust |

|

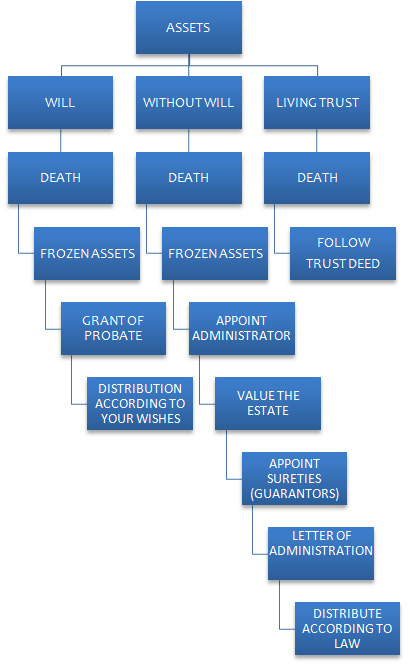

| When is the actual transfer of property? | After death of testator and the estate administration process | During lifetime of Settlor |

| When does it become effective? | Upon death of testator | Upon transfer of property to trustee |

| What is the effect of the death of the Testator or Settlor? | Assets frozen upon death of testator | Assets held on trust can be execute immediately |

| Is any application to Court necessary? | Grant of Probate must be obtained to unfreeze assets of Testator. | No application to Court necessary |

| Does marriage affect it? | Revoked upon marriage | Not revoked upon marriage |

| Can there be more than one? | Testator's latest Will automatically revokes earlier Wills | Settlor can create more than one Trust. |

| Can it be revoked by the person who made it? | Testator can revoke Will at any time | Settlor can revoke trust if there is a revocation clause in the trust deed. |

| Is it effective in giving away future property? | Testator can include property which he anticipates receiving in the future. | No. Settlor cannot purport to transfer property not yet owned. |

Lebih maklumat tentang Flora Trustee Berhad

Lebih maklumat tentang Flora Trustee Berhad

Malaysia

Malaysia