Welcoming a child into the world is surely the most precious of life’s gifts. During the delicate months of pregnancy as well as infancy, every mother and her baby needs extra love, care and attention.

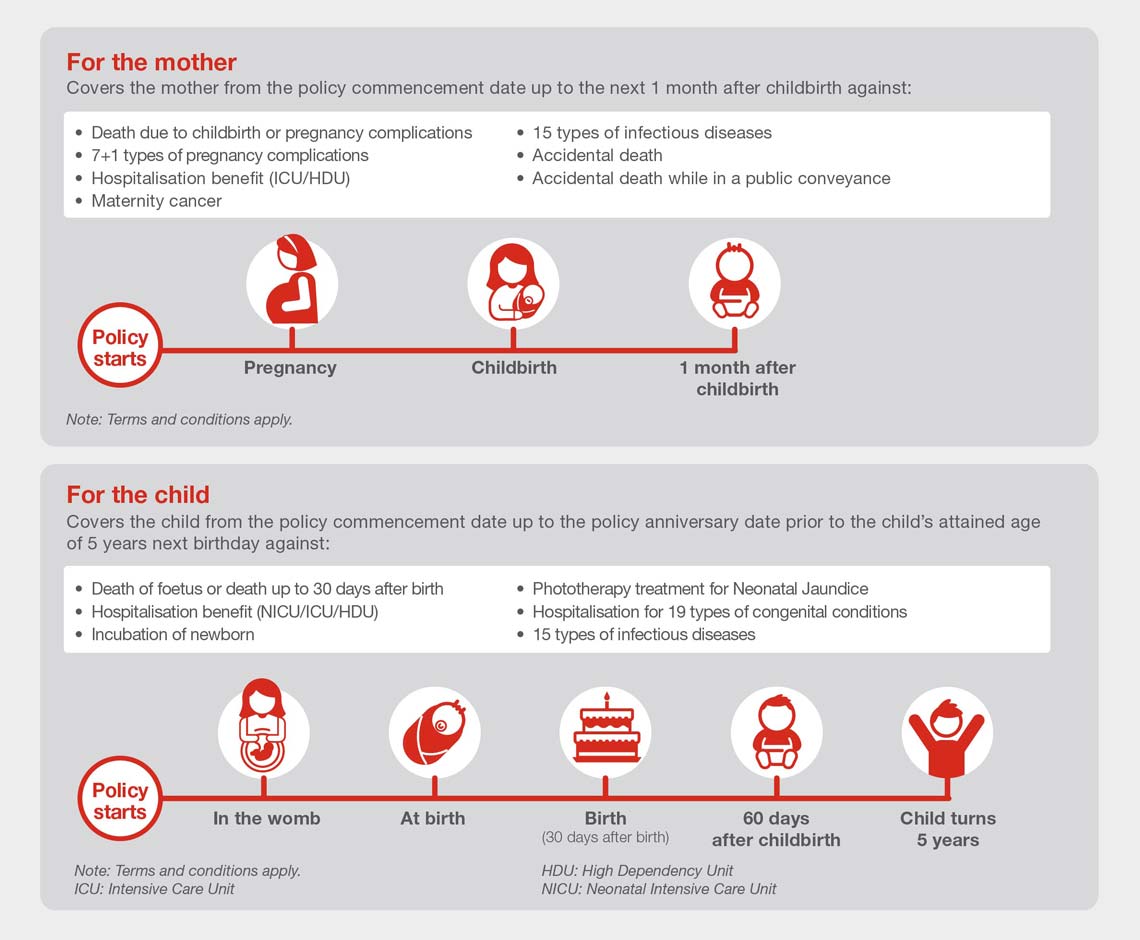

When you add the Smart Baby Shield rider to your SmartProtect Junior, you and your baby can enjoy comprehensive protection while you are still expecting, and even after you deliver your little bundle of joy. It provides protection against the unexpected, hospitalisation benefits and additional features to help you both through this crucial period of life. With Smart Baby Shield, you can enjoy complete peace of mind to make this a time to cherish and remember.

Greater assurance during pregnancy

Should any of the covered complications arise during your pregnancy, you will receive a lump sum benefit of RM5,000 to help with treatment costs1 .

Life protection against the unexpected

In the event of death of the mother due to complications from childbirth or pregnancy5 , you will receive a lump sum benefit of RM30,000. Should death of the child occur during pregnancy6 , a lump sum of RM5,000 and the Total Investment Value will be payable to you1 .

Daily hospitalisation cash benefits

Smart Baby Shield provides daily cash benefits of RM5002 should you or your child require admission to either NICU/ICU/HDU3 , giving you peace of mind.

Protection against accidental death

To help secure the future for your loved ones, an accidental death benefit of RM30,000 will be payable upon the death of the mother prior to delivery and up to 1 month after delivery. Upon accidental death due to public conveyance7 , RM60,000 will be payable1 .

Protection for diseases & infections

With Smart Baby Shield, you are financially protected against several infectious diseases and congenital conditions that may strike you or your baby1 .

Basic coverage against maternity cancer

Upon diagnosis of cancer in the expecting mother, Smart Baby Shield provides financial aid to support you on the path to recovery1 .

Critical protection for your newborn

This plan covers urgent care for your newborn. If your child is required to be placed in an incubator within 60 days of birth, a cash benefit of RM200 will be payable daily4 . A lump sum benefit of RM1,000 is also payable if your newborn is in need of Phototherapy Treatment for Neonatal Jaundice1 .

Please do take note of the below to ensure you fully understand what this product does and does not cover.

1 Terms and conditions apply.

2 Up to 1 month after delivery for the mother and up to a maximum of 60 days for the newborn.

3 NICU: Neonatal Intensive Care Unit, ICU: Intensive Care Unit, HDU: High Dependency Unit.

4 Up to a maximum of 60 days.

5 Prior to delivery and up to 1 month after delivery.

6 At delivery or up to 30 days after birth.

7 Accidental death of the mother resulted while travelling in a public conveyance (other than a cable car, taxi, hired car or any form of transport chartered for private travel); or while riding as a passenger in an elevator or in an electric lift or in consequence of the burning of any theatre or cinema, hotel or other public building in which the mother shall be present at the time of commencement of the fire.

Smart Baby Shield is comprised of two unit deduction riders attachable to selected regular premium investment-linked insurance plans. These plans are insurance products that are tied to the performance of the underlying assets, and are not pure investment products such as unit trusts. The insurance charge to be imposed will be deducted from the total investment value of your policy. You may stop paying premiums under the policy and still enjoy protection as long as there is sufficient total investment value to pay for the insurance charges. However, there is a possibility of the policy lapsing when the required charges, including rider charges, exceed the total investment value of the fund units available.

You can attach Smart Baby Shield to SmartProtect Junior only. Both riders under Smart Baby Shield must be attached together; should one of the riders be terminated, the other rider will be terminated as well.

You should satisfy yourself that these riders will best serve your needs and that the premium payable under the policy is an amount you can afford. A free-look period of 15 days is given for you to review the suitability of the plan. If these riders are cancelled during this period, the policy owner is entitled to the reinstatement of the units deducted for the payment of insurance charges after net of expenses incurred for the medical examination, if any. If you switch your policy/rider from one company to another, or if you exchange your current policy/rider with another policy/rider within the same company, you may be required to submit an application where acceptance of your proposal will be subject to the terms and conditions to be imposed at the time of policy/rider switching or replacement.

This brochure is for general information only. It is not a contract of insurance. You are advised to refer to the Sales Illustration, Product Disclosure Sheet, consumer education booklet on Medical and Health Insurance (MHI) and sample policy documents for detailed important features and benefits of the plan before purchasing the plan. The exclusions and limitations highlighted above are not exhaustive. For further information, reference shall be made to the terms and conditions specified in the policy issued by Great Eastern Life.

If there is any discrepancy between the English, Bahasa Malaysia, and Chinese versions of this brochure, the English version shall prevail.

The terms “Great Eastern Life” and “the Company” shall refer to Great Eastern Life Assurance (Malaysia) Berhad.

Information correct as on 15 April 2019.

Malaysia

Malaysia