As the property market in Southeast Asia continues to evolve, cities like Johor Bahru are emerging as attractive alternatives to more established markets such as Singapore, Bangkok, and Jakarta. With a combination of strategic location, affordability, and ongoing development, Johor Bahru offers unique opportunities for investors and homebuyers alike. This article provides a detailed comparison of Johor Bahru's property market with other major Southeast Asian cities, helping you understand where the best investment opportunities lie.

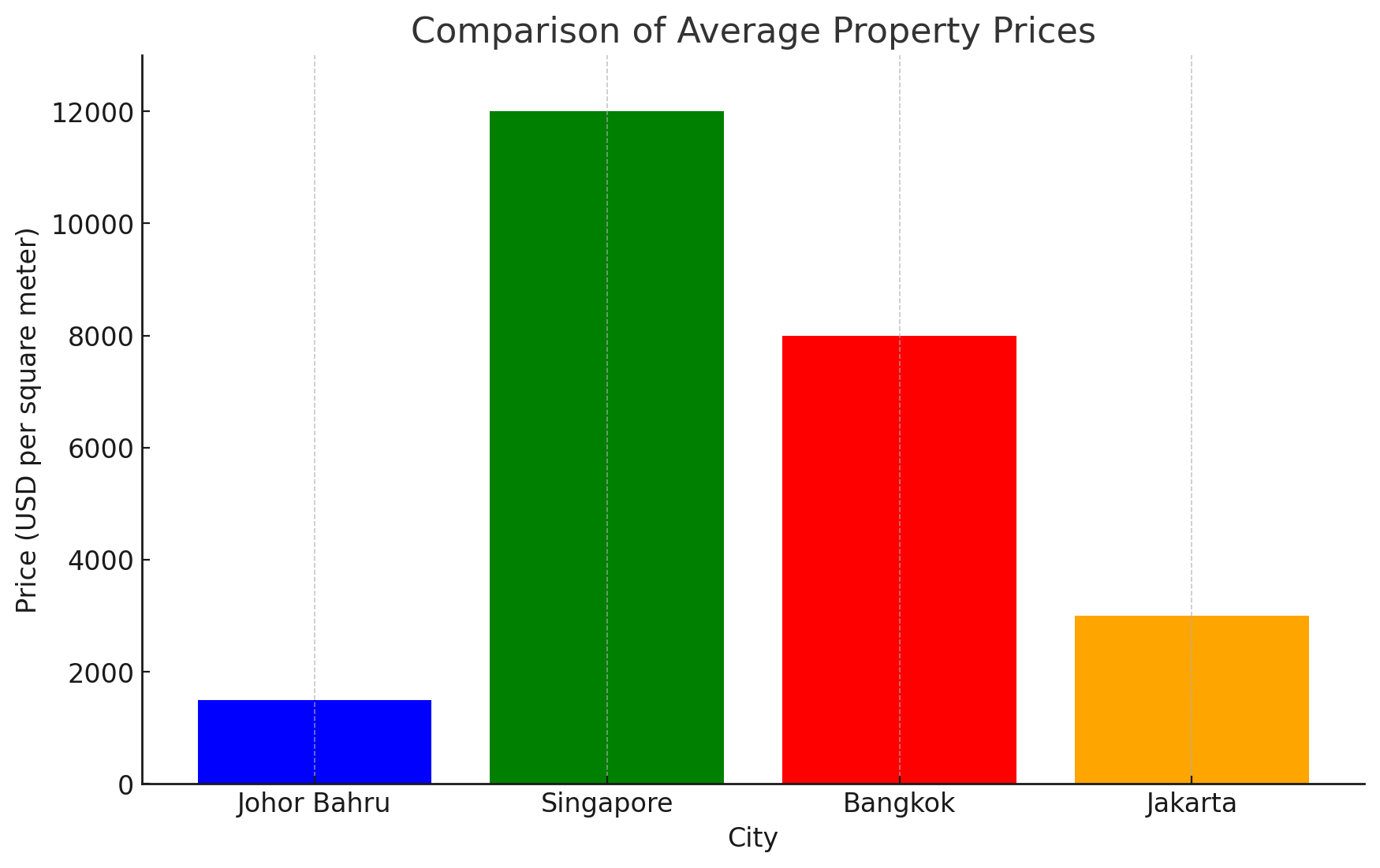

When comparing property markets across Southeast Asia, affordability is a key factor for both investors and homebuyers:

Johor Bahru: Known for its relatively affordable property prices, Johor Bahru provides a cost-effective option for investors. The city’s proximity to Singapore, combined with significantly lower property prices, makes it an attractive choice for those looking to maximize their purchasing power.

Singapore: As one of the most expensive property markets in the world, Singapore’s real estate prices are high due to limited land supply and strong demand. Investors looking at Singapore must be prepared for high capital outlays, though the market offers stable returns and strong rental demand due to its status as a global financial hub.

Bangkok: Bangkok’s property market offers a range of prices depending on location and property type. While still more affordable than Singapore, prime areas in Bangkok, like Sukhumvit and Silom, can command high prices. However, there are also many affordable options in emerging neighborhoods, making it suitable for a broad range of investors.

Jakarta: Jakarta offers a more affordable property market compared to Singapore and Bangkok. The city has seen steady growth in real estate development, driven by economic expansion and urbanization. Property prices in Jakarta can vary widely, with luxury developments in areas like Central Jakarta being more expensive, while suburban areas offer more affordable options.

For investors, understanding rental yields and potential returns is crucial when choosing a property market:

Johor Bahru: The rental yield in Johor Bahru is relatively high due to lower property prices and strong demand from expatriates and cross-border workers from Singapore. Investors can achieve good returns, particularly in strategically located properties near the city center or close to the Singaporean border.

Singapore: Despite high property prices, rental yields in Singapore can be moderate. However, the city’s stability, strong regulatory framework, and robust economy make it a safe investment. Singapore remains attractive for investors looking for long-term capital appreciation and low-risk environments.

Bangkok: Bangkok offers competitive rental yields, especially in popular expatriate and tourist areas. High demand from both locals and foreigners for rentals in prime locations like Sukhumvit and Sathorn drives rental returns, making it a viable market for investors seeking short to medium-term gains.

Jakarta: Jakarta’s rental yields vary, with higher yields often found in more affordable and emerging areas. The city's expanding middle class and increased foreign business presence contribute to rental demand, providing decent investment returns for properties in strategic locations.

Economic conditions and market stability greatly influence real estate investment decisions:

Johor Bahru: Johor Bahru benefits from Malaysia’s relatively stable economy and its position as a gateway to Singapore. The Iskandar Malaysia project, aimed at transforming the region into a robust economic zone, enhances Johor Bahru’s appeal. However, the market can be influenced by broader economic conditions in Malaysia and policy changes affecting foreign ownership.

Singapore: Singapore’s property market is highly stable, backed by a strong economy and transparent legal framework. The government’s proactive measures, such as property cooling policies, help maintain market stability and prevent speculative bubbles. This stability makes Singapore an attractive choice for risk-averse investors.

Bangkok: Thailand’s property market is supported by a strong tourism sector and a growing economy. However, political instability and regulatory changes can impact market confidence. Investors should be aware of potential risks associated with political developments and ensure compliance with local regulations.

Jakarta: Indonesia’s property market has been bolstered by strong economic growth and urbanization. However, Jakarta’s market can be affected by economic fluctuations, regulatory changes, and infrastructure challenges. The government’s efforts to improve infrastructure and investment policies are positive signs, but investors should remain cautious about potential risks.

.jpg)

Understanding the regulatory environment and foreign ownership rules is essential for foreign investors:

Johor Bahru: Malaysia offers a relatively investor-friendly environment, with foreign ownership allowed for properties above a certain price threshold. The MM2H program further facilitates long-term residency for foreign investors. However, there are specific regulations on property types and minimum investment amounts that investors need to consider.

Singapore: Singapore has stringent rules on foreign property ownership, particularly for landed properties. Foreigners can purchase condominiums without restrictions, but additional taxes and stamp duties apply. The government’s policies aim to maintain affordability for locals while managing foreign investment.

Bangkok: In Thailand, foreign investors can own condominium units but not land. The law allows foreign ownership of up to 49% of the total floor area of a condominium building. For other property types, foreigners typically use long-term lease agreements. It’s crucial for investors to understand these limitations and seek legal advice.

Jakarta: Indonesia’s foreign ownership laws are relatively restrictive. Foreigners cannot own land but can acquire properties through long-term leases or the right-to-use titles. Recent reforms have aimed at making it easier for foreign investors to participate in the property market, but complexities remain. Consulting local experts is advised for navigating these regulations.

Looking ahead, understanding future trends can help investors make informed decisions:

Johor Bahru: With ongoing infrastructure projects like the RTS Link and developments in Iskandar Malaysia, Johor Bahru’s property market is poised for growth. The city’s affordability, strategic location, and government initiatives make it an attractive market for future investment opportunities.

Singapore: As a mature market, Singapore offers steady growth with limited room for explosive price increases. However, its status as a global financial hub, strong legal framework, and stable political environment continue to make it a safe and attractive investment destination.

Bangkok: Bangkok is expected to see continued growth, driven by tourism, a growing expatriate community, and infrastructure improvements like the expansion of the BTS Skytrain. Emerging neighborhoods and new developments present opportunities for higher returns in the medium to long term.

Jakarta: Jakarta’s property market is set to benefit from ongoing urbanization and infrastructure development projects, such as the Mass Rapid Transit (MRT) system. While the market presents opportunities, investors should be mindful of regulatory changes and economic conditions that may impact future growth.

Each Southeast Asian city offers unique advantages and challenges for property investors. Johor Bahru stands out for its affordability, proximity to Singapore, and growth potential driven by ongoing infrastructure projects and government initiatives. While cities like Singapore, Bangkok, and Jakarta each have their own strengths, investors should carefully consider their investment goals, risk tolerance, and market conditions when choosing where to invest.

China

China