What is Transfer Pricing?

Transfer pricing (TP) is a tax concept where companies operating within a group (also known as controlled transactions) are required to transact with one another at market price (also known as arm’s length transactions). In short, such transactions should be conducted as if carried out with any independent parties under similar economic circumstances.

Rules govern the Transfer Pricing ruling are

Income Tax (Transfer Pricing) Rules 2023 [P.U. (A) 165/2023] and

Section 140A of Income Tax Act 1967

What is Controlled Transactions?

A person or company enters into a transaction with an associated person or company (directly or indirectly involved in management, control, or capital of other company) for the acquisition or supply of property or services including financial assistance, where at least one person is assessable or chargeable to tax in Malaysia.

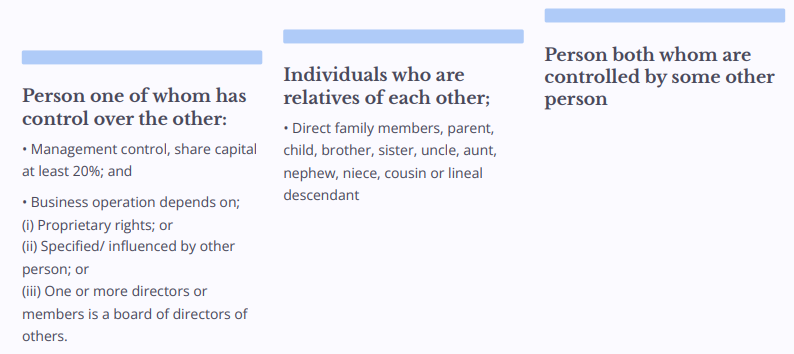

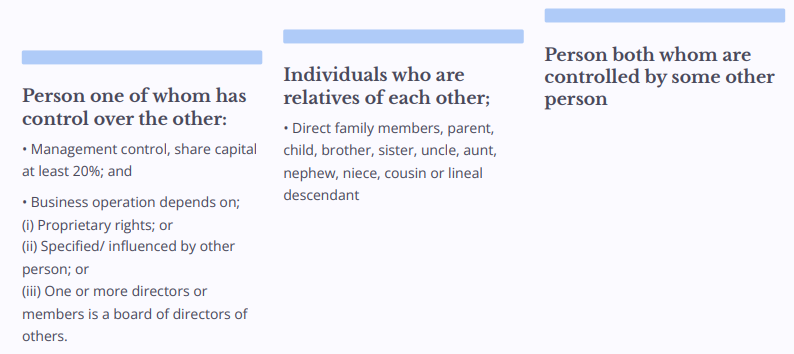

Transaction with associated person refers to the transaction between: -

Example of Control and Associate in Malaysia

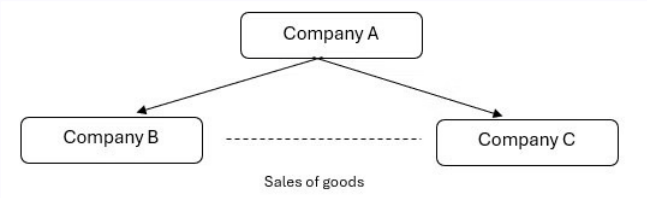

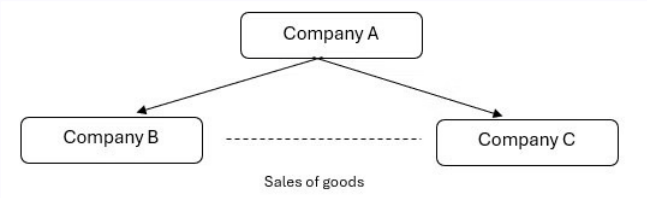

Example 1:

The Company A has control over the Company B & Company C through shares ownership. Therefore, Company B & C are associated company. Thus, transfer pricing laws apply to the transactions between the two companies.

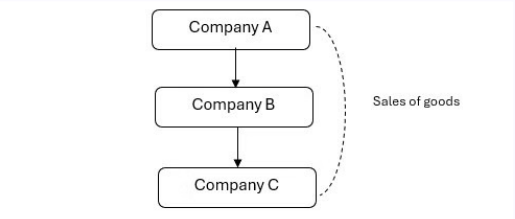

Example of Control and Associate in Malaysia

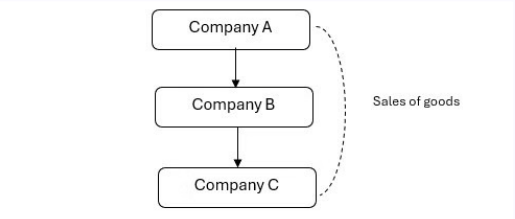

Example 2:

Company A has control over Company B, which in turn has control over Company C. Thus, Company A indirectly controls Company C, and transfer pricing law applies to the transactions between the two.

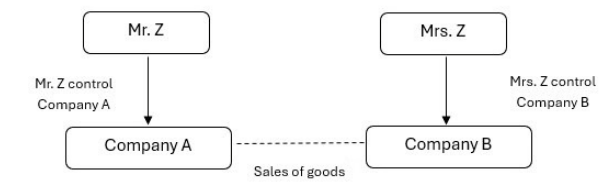

Example of Control and Associate in Malaysia

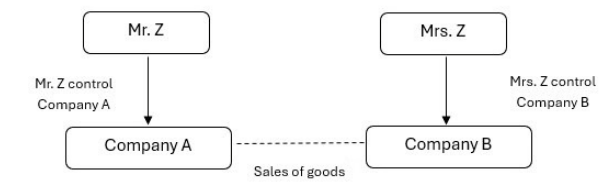

Example 3:

Transactions between Company A and Company B, are deemed controlled transactions due to relationship between Mr. Z and Mrs Z as husband and wife.

Transfer Pricing Requirements

A person or company who participates in a controlled transaction needs to prepare the contemporaneous transfer pricing documentation (CTPD). A person or company shall prepare a full CTPD as provided under the Rules if fulfills the following requirements: -

- Gross income more than RM30 million in total and engage in cross–border controlled transactions RM10 million and more annually; OR

- Receives/provides controlled financial assistance of more than RM50 million annually; OR

- Permanent establishment (PE) company.

Refer to paragraph 1.7 of Malaysia Transfer Pricing Guidelines 2024 (page 5) for example of scenarios.

Exemption on Preparation of CTPD (Optional to prepare full or minimum CTPD)

According to paragraph 1.5 of Malaysia Transfer Pricing Guidelines 2024, the following person or Company are not required to prepare a CTPD: -

- Individuals not carrying a business; OR

- Individuals carrying a business (including partnership) and only engaged in domestic controlled transactions; OR

- A person enter into controlled transactions with a total amounting to not more than RM1 million; OR

- A person entered solely into a domestic controlled transaction with another person where both parties: -

- Do not enjoy tax incentives

- Are taxed at the same rate;

- Do not suffer losses for two consecutive years prior to the controlled transactions

However, the exempted person must still comply with the arm’s length principle for all controlled transactions and keep all relevant documents to support and prove the determination of the arm's length principle.

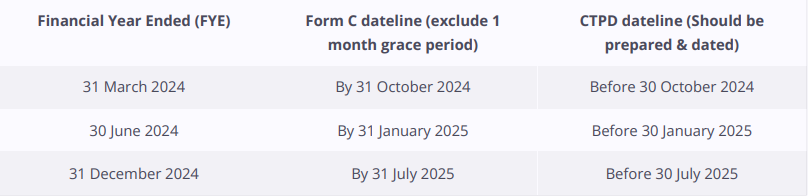

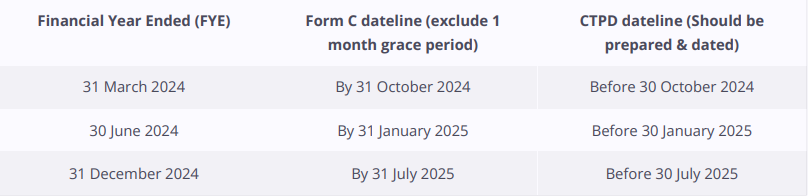

Transfer Pricing Documentation Timeline

- CTPD is not required to be submitted together with Form C (Income Tax Return Form).

- CTPD is required to be submitted within 14 days upon request by IRBM (Inland Revenue Board of Malaysia).

- Must be prepared prior to the due date for filing the tax return or prior to the submission of Form C for the basis year.

Penalty on Transfer Pricing

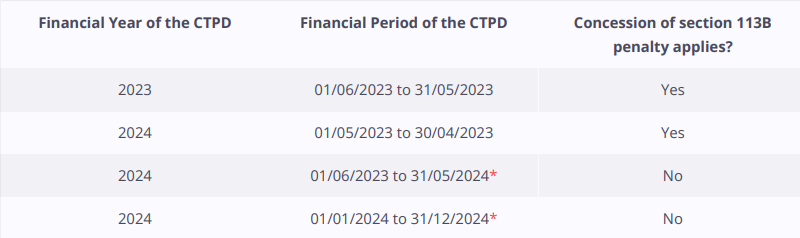

a) Failure to furnish CTPD within 14 days upon request by IRBM (Section 113B of Income Tax Act 1967): -

- Penalty between RM20,000 and RM100,000 or imprisonment for a term up to 6 months or both;

- To furnish CTPD within 30 days or the period decided by the Court.

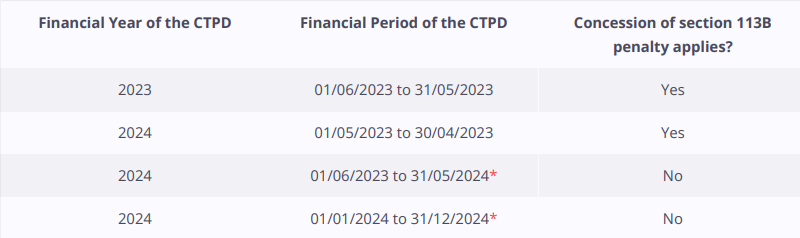

A

concession for the penalties under section 113B of the ITA 1967 is given to taxpayers with an accounting period that begins before 29th May 2023.

*Note: No concession for the FYE 31 May 2024 onwards.

*Note: No concession for the FYE 31 May 2024 onwards.

b) Adjustment made on transfer pricing by IRBM (Section 140A(3C) of Income Tax Act 1967): -

Surcharge of up to 5%* on TP adjustments regardless of whether there is an additional tax payable on the adjustments made.

*Notes: Surcharge imposed on the the TP adjustment amount and not on the additional tax payable.

For more details, visit the official page:

Transfer Pricing - LHDN Malaysia.

Japan

Japan