This article first appeared in The Edge Malaysia Weekly on October 14, 2024 - October 20, 2024

The Malaysian property sector recovery remains intact based on the most recent available statistics. Residential property sales (by value) are rising nationwide, on the back of increases in both volume demand and prices, and — this might come as a shock to many — underpinned by improving home affordability, contrary to popular misconception that is often perpetuated by the media and even government authorities. At the same time, unsold units are decreasing, boosting homebuyer confidence in the sustainability of this recovery and overall sentiment for the sector. All the data are supportive of the property sector’s turnaround after years of sluggish demand a

To briefly recap, the DIBS scheme, introduced in 2009, allowed developers to absorb all the interest costs on mortgages during the construction period. The resulting “free holding cost” during the construction period for homebuyers drove massive speculative activities — buyers bought properties with the intention to flip them on completion — causing prices to surge and making homes rapidly unaffordable. The DIBS scheme was abolished in Budget 2014. That led to a sharp contraction in demand — the number of transactions fell — amid incoming supply. Unsold units piled up, exerting downward pressure on home prices and eroding buyer confidence. Home prices became stagnant, and even fell in some market segments, including high-rise and high-priced properties. It took years for the property market to rebalance and regain its footing. Demand did not start recovering until around 2018 but was interrupted by the Covid-19 pandemic.

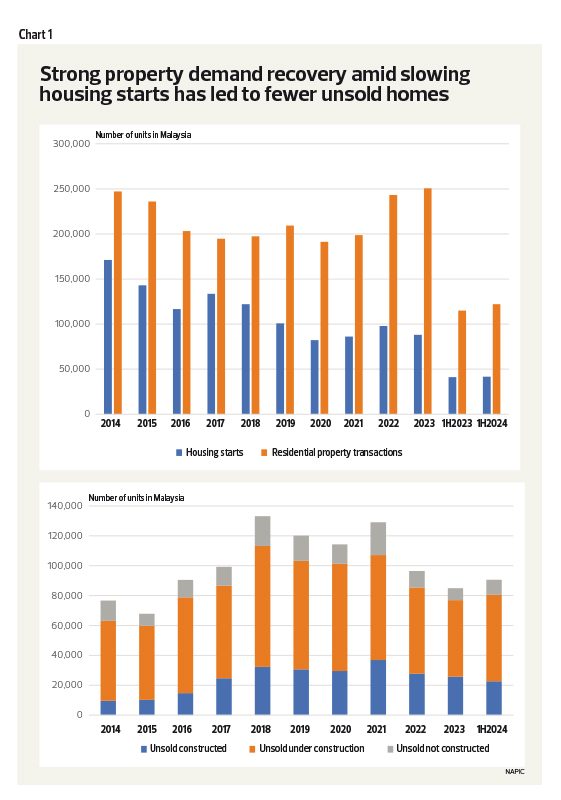

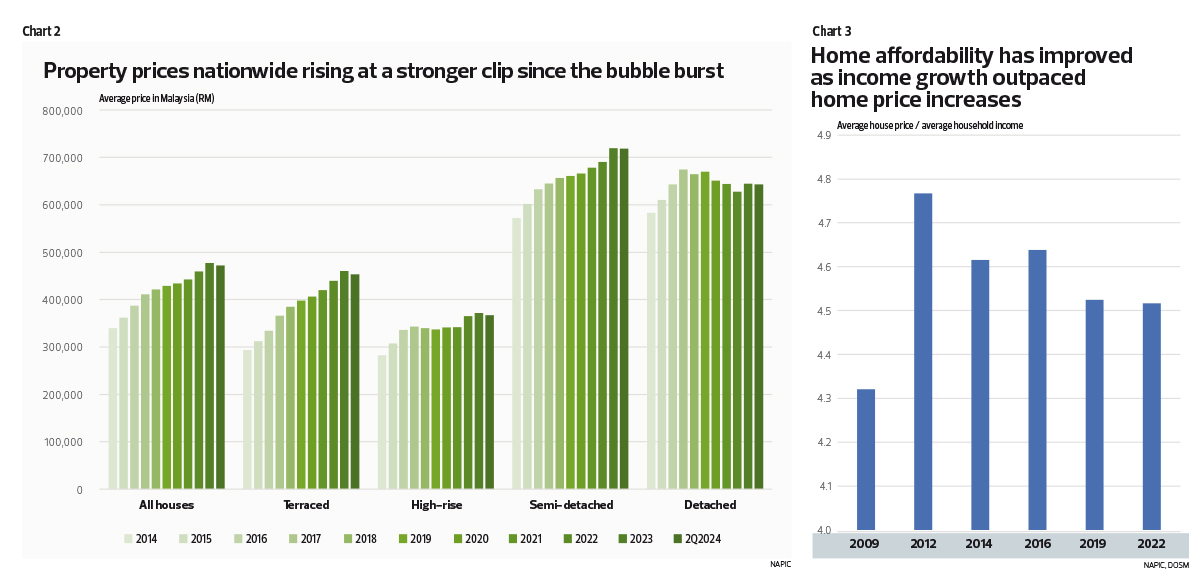

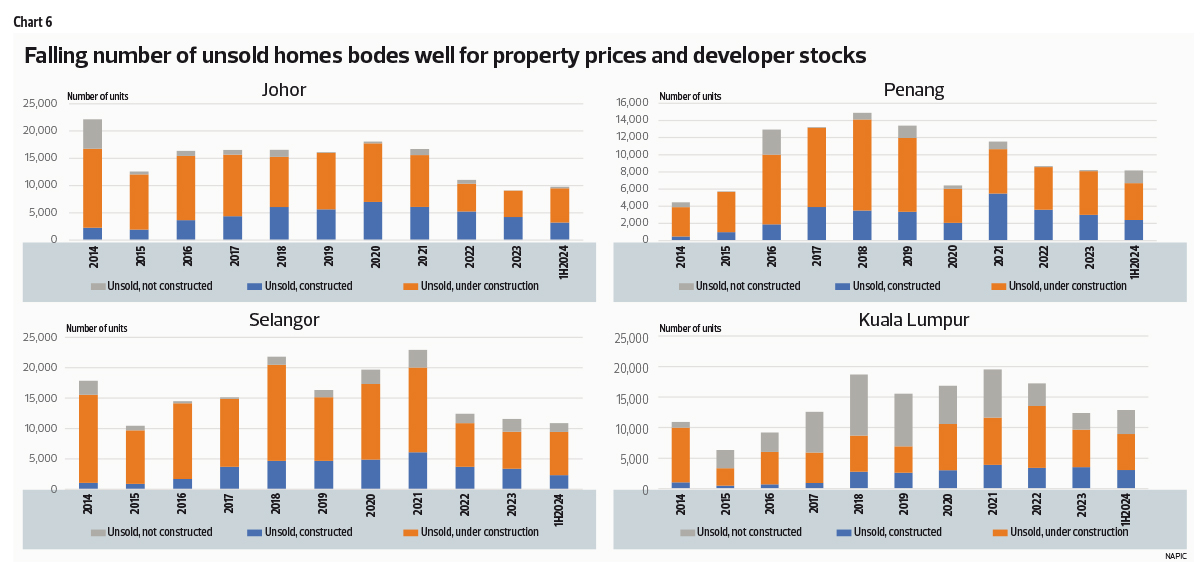

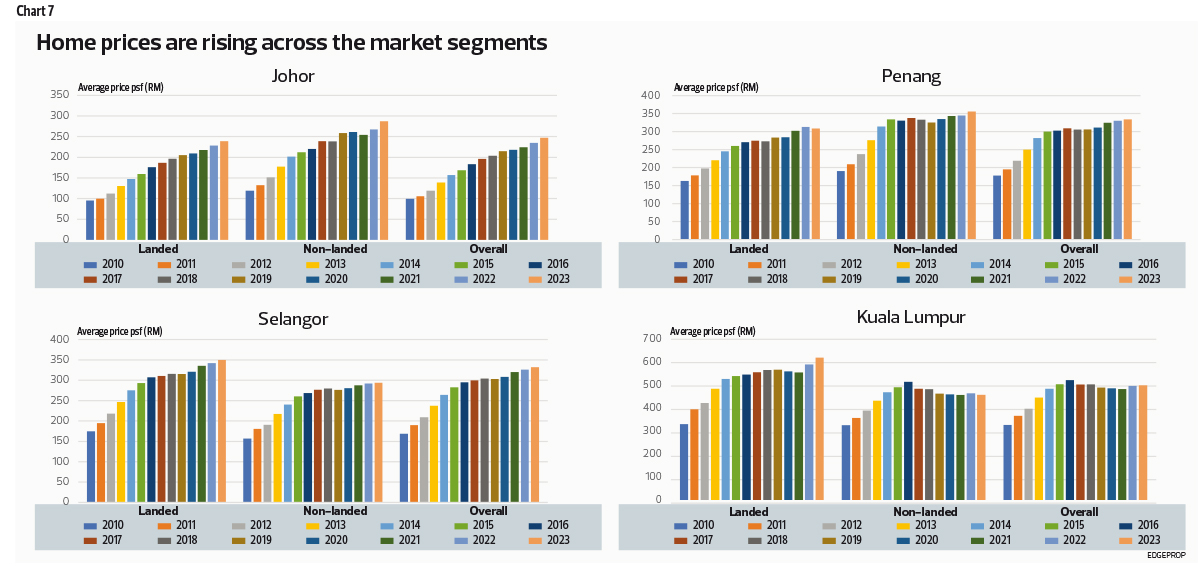

The post-pandemic property sales in 2022-2023 have been strong, even after taking into account effects of pent-up demand (that would taper off) — y-o-y growth remains positive in 1Q2024. Developers have also been generally more disciplined in launching new projects. As a result, unsold stock across the country fell on the back of the recovering demand and fewer housing starts (see Chart 1). And home prices are rising now at a faster clip across all market segments (see Chart 2) — not just because of stronger demand but also due to rising costs, including wages.

nd lacklustre outlook following the Developer Interest Bearing Scheme (DIBS) bubble burst.

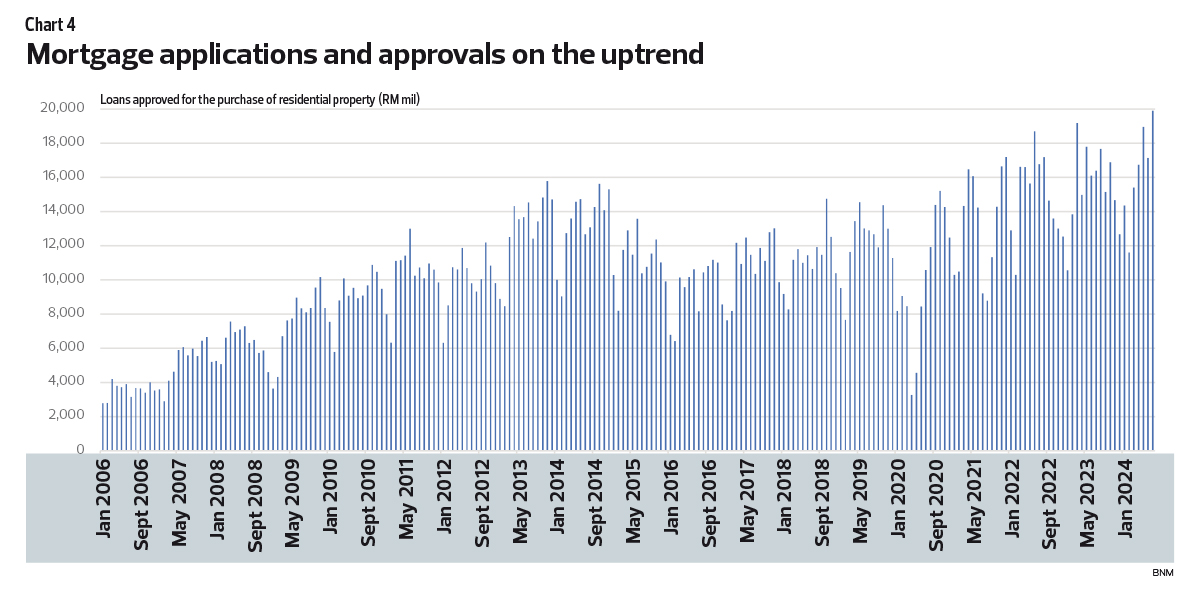

As we said, home prices have stayed somewhat flattish for years after the DIBS bubble burst. While this has affected buyer confidence and resulted in a lacklustre property market, it has also allowed income to catch up with the DIBS-driven price surge (in 2009-2012). Household income grew faster than house prices from 2012 to 2022. As a result, home ownership affordability in Malaysia, on average, improved over this period — that is, the ratio of average home price to average household income fell (see Chart 3). Improving affordability underpinned the rise in mortgage applications and loan approvals — loan approvals continued to trend higher, up to the latest June 2024 figures (see Chart 4).

All of the above data supports our belief, which we articulated back in February, that the worst is over for the residential property market. We think demand and prices will continue to trend higher going forward, supported by Malaysia’s favourable demographics including a growing population and the number of households. Of course, there will be some differences in terms of the degree of improvement among the states.

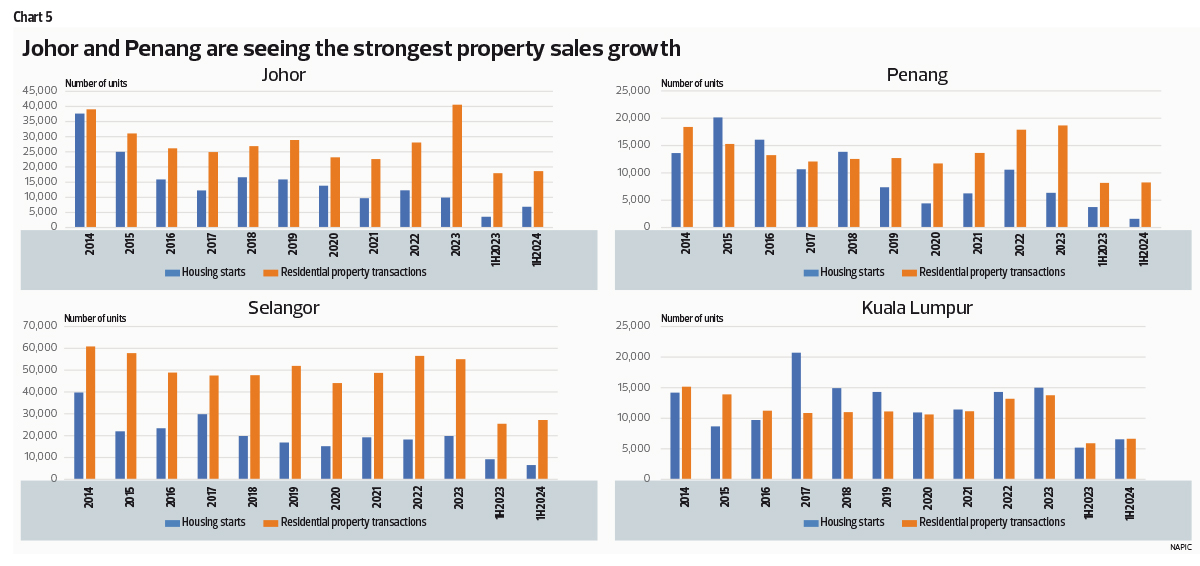

We took a closer look at the property data by states. The demand recovery appears to be strongest in Johor (75% increase in residential transactions between 2020 and 2023), followed by Penang (+59%) while that in KL (+30%) and Selangor (+25%) are comparatively slower, but still relatively robust (see Chart 5).

This is perhaps not surprising given the positivity surrounding the Rapid Transit System (currently under construction and slated for completion by end-2026) and the potential for greater economic integration between Johor and Singapore spurring renewed interest from homebuyers, including Singaporeans. Penang too is drawing buyers on the promise of increased investments and stronger growth in the electrical and electronics (E&E) sector. The state is developing a number of new industrial parks such as Bandar Cassia Technology Park (155ha), Batu Kawan Industrial Park 3 (252ha) and Penang Science Park South (71ha), with a total investment cost of RM3.2 billion — and is attracting more than its fair share of foreign direct investment (FDI).

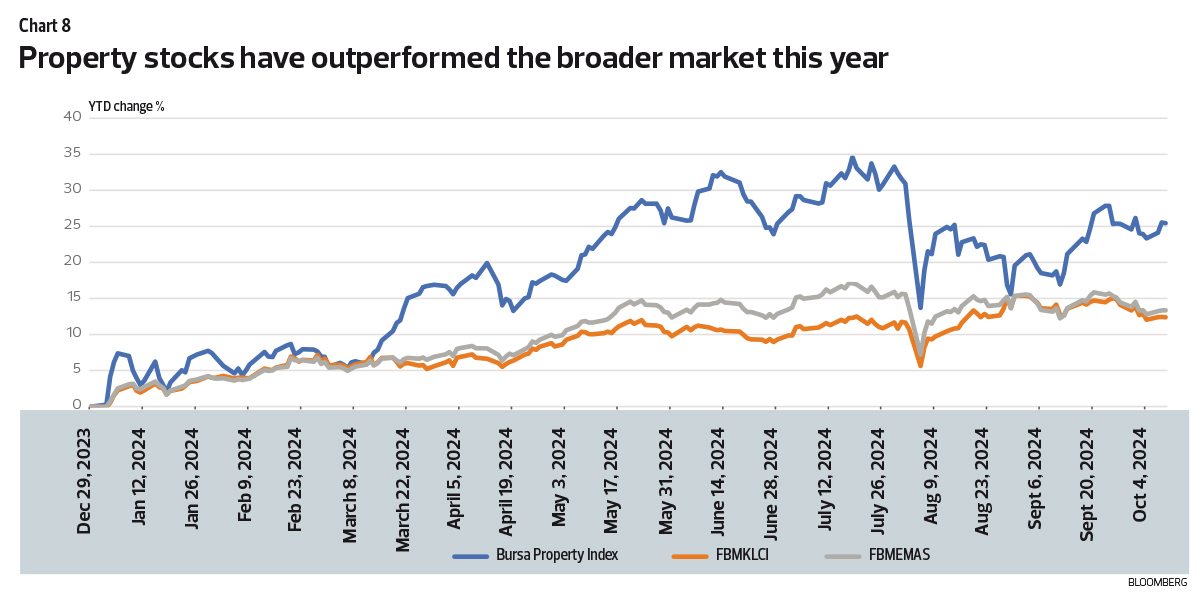

At the same time, the number of new housing starts in Johor and Penang too have fallen the steepest from the highs in 2014-2015, leading to lower unsold homes (see Chart 6) — and prices are rising across all market segments (see Chart 7). Stocks for property developers — especially those with exposure to the two states — as well as the large construction companies have already rallied strongly in anticipation of a more buoyant Malaysian residential property market going forward (see Chart 8).

The Absolute Returns Portfolio fell 1.8% for the week ended Oct 9, paring total returns since inception to 12.9%. The top gainers for the week were CrowdStrike (+6.5%), DBS Group Holdings (+1.5%) and CRH (+0.6%), while the top losers were Tencent Holdings (-7.7%), Swire Properties (-6.7%) and Itochu (-3.7%).

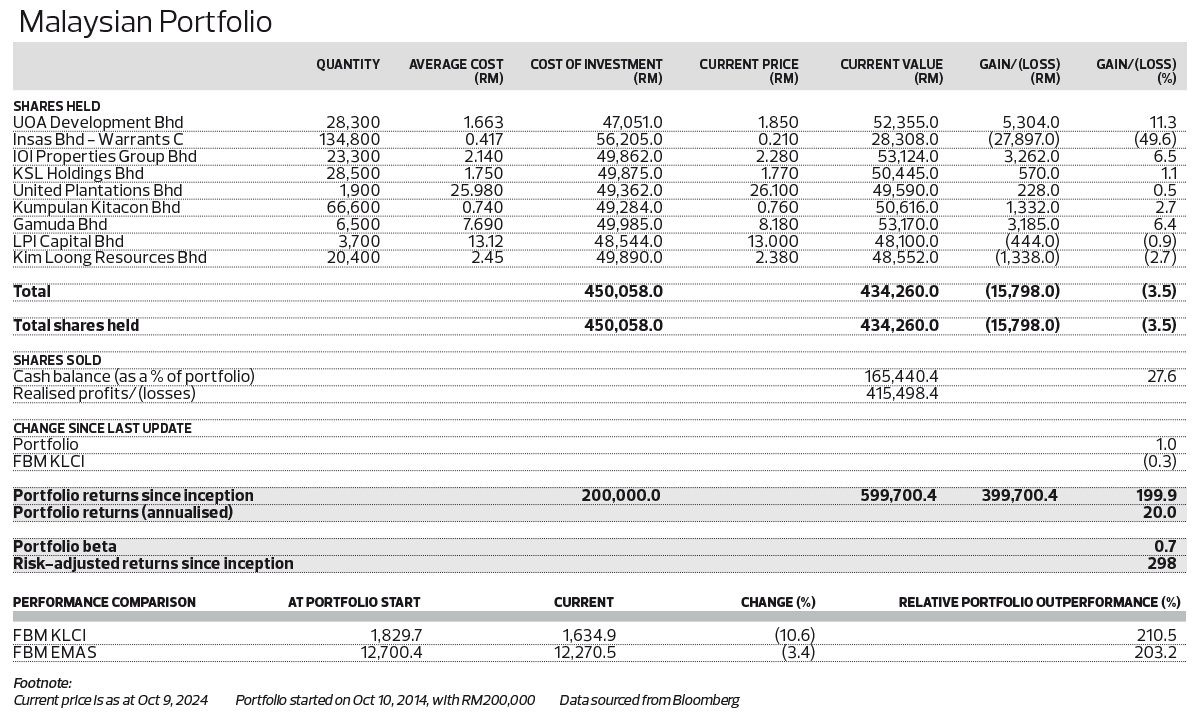

Malaysia

Malaysia