Ace Excellent Consulting works with companies throughout the IPO proceeds, ease complexity, and position parent and new companies for a successful path in the capital markets.

Ace Excellent Consulting brings a holistic, end-to-end perspective to the IPO process. Our IPO consultants help to optimize IPO proceeds while delving into every facet of an offering. IPOs are highly complex transactions that can involve numerous interlocking business, financial, and legal details. From initial rationale to post-separation technicalities, we work to advance each company's prospects and market leadership.

IPO don't always deliver value. Our research shows that three out of ten IPOs with more than $500 million in annual revenues fail to outperform the market in the first year; this rises to about 50% of smaller IPOs. Ace Excellent Consulting's IPO consulting services help clients navigate the demanding deal process while maximizing returns and long-term value.

Before the process starts, we help you develop the overall IPO strategy by defining the deal rationale and the right perimeter (or scope), and assessing the value potential for the company, potential investors, and existing shareholders.

We can also deploy a thorough readiness assessment, identifying any gaps and helping you close them quickly and efficiently ahead of the IPO.

We focus on creating a powerful, integrated IPO equity story to demonstrate expected value creation through a combination of growth, cost reduction, and improved cash flow. Only by shaping the right equity story can companies meet funding targets and tread a successful path in the market.

We help build a detailed, investor-proof business plan supporting the value creation story. A deeply substantiated and sufficiently ambitious plan, backed by clear proof points, provides a strong basis for investor and analyst guidance and communication.

We enable you to continue running your business without distraction and manage complexity across stakeholders, from markets and existing shareholders to employees and advisors. No matter how high your IPO launch-day proceeds may be, an offering is only as successful as the business - or businesses - you're left with after the stock exchange's closing bell rings.

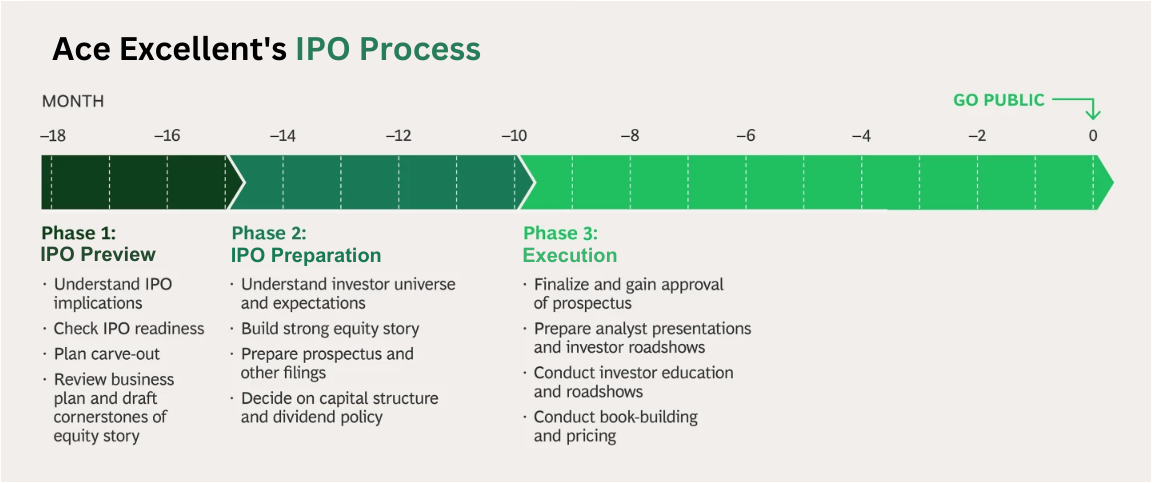

We are experienced in helping growing companies to list on the NASDAQ Exchange. Our IPO advisory work entails the following phases in getting your company ready for IPO. We will work closely with the management to determine the best time for the exercise, provide the necessary assistance and guidance through the entire process and to the extent possible, expedite the IPO preparatory work.

Every Ace Excellent Consulting engagement begins with a deep exploration of your business. From there, we launch the IPO process by examining whether an IPO is in fact the best option. A private sale to another industry player, known as a trade sale, or to a private equity firm may be preferable or equally promising.

IPO planning often takes place in parallel with a carve-out process, separating the target entity from its corporate parent operationally and financially. Like IPOs themselves, carve-outs typically are large-scale, high-stakes projects involving complex activities and a multitude of details.

Once a company has decided to pursue an IPO, the real work begins. While IPOs can happen in as few as 8 months, 12 to is months is a more realistic timeline to ensure the company is well prepared for its journey as a publicly listed entity.

Our comprehensive, proven approach divides the IPO runway into three phases: Pre-IPO Review, IPO preparation and Execution—each aiming to improve the chances of a successful IPO.

Singapore

Singapore